India’s Banking System: Structure, Functions, and Key Players

India’s banking system plays a crucial role in the country’s economy by supporting growth, facilitating financial transactions, and providing services to individuals, businesses, and the government. The system is vast, well-structured, and regulated to ensure smooth and efficient functioning.

1. Structure of India’s Banking System

The banking system in India includes public sector banks, private sector banks, foreign banks, and cooperative banks. It is regulated by the Reserve Bank of India (RBI), the country’s central bank.

A. Types of Banks in India

1. Commercial Banks

These are the primary banks that offer services like accepting deposits, giving loans, and facilitating payments.

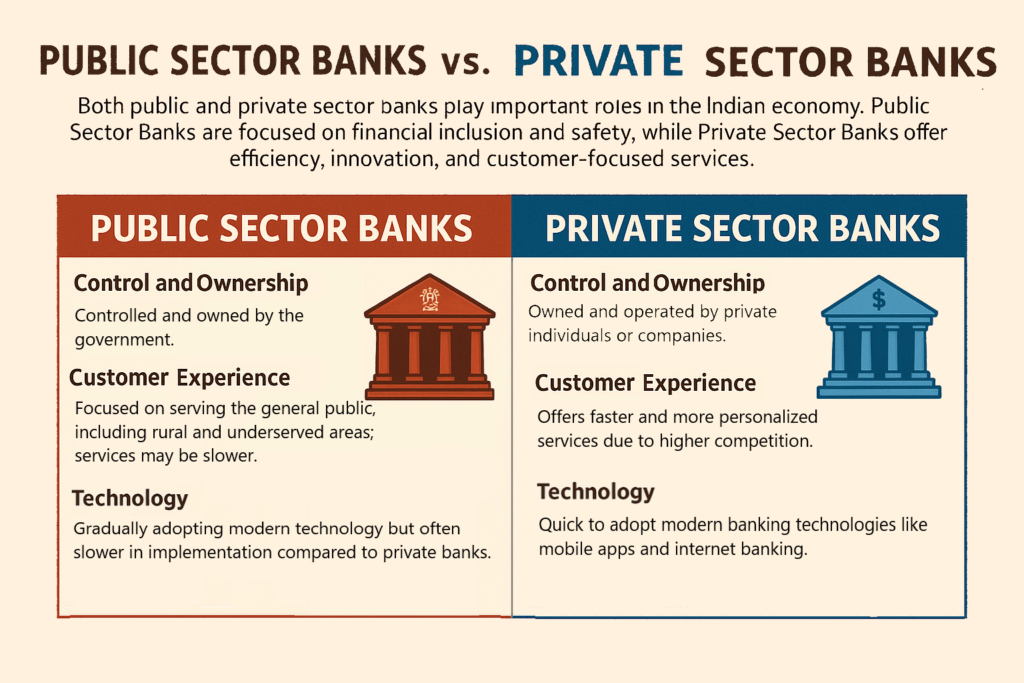

- Public Sector Banks: Owned by the government and forming the largest part of the sector. Examples:

- State Bank of India (SBI)

- Bank of Baroda

- Punjab National Bank

They serve both rural and urban populations.

- Private Sector Banks: Privately owned banks known for innovative services and customer experience. Examples:

- HDFC Bank

- ICICI Bank

- Axis Bank

- Foreign Banks: Banks headquartered outside India but operating within the country. Examples:

- Citibank

- HSBC

2. Cooperative Banks

Owned and controlled by their members, often serving specific communities or sectors. Particularly vital in rural areas.

- Urban Cooperative Banks: Operate in urban areas providing savings and loans.

- Rural Cooperative Banks: Support agricultural credit and rural financing.

3. Regional Rural Banks (RRBs)

RRBs focus on rural financial inclusion and agricultural support. These are joint ventures among the central government, state governments, and sponsoring commercial banks.

2. Functions of India’s Banking System

The Indian banking system supports the economy through various critical functions:

A. Accepting Deposits

Banks collect public deposits through savings accounts, current accounts, and fixed deposits, helping people save securely.

B. Providing Loans and Credit

Banks lend to individuals, businesses, and governments. Loan types include:

- Personal Loans: For education, home, or medical expenses.

- Business Loans: For expansion, equipment, or working capital.

- Agricultural Loans: To support farming needs.

C. Facilitating Payments and Money Transfer

Banks enable transactions through cheques, EFTs, RTGS, NEFT, and ATMs.

D. Investment Services

Banks offer financial products to help customers grow wealth:

- Mutual Funds

- Bonds

- Insurance (life and health)

E. Foreign Exchange and Trade Services

- Letters of Credit (LC): For international trade guarantees.

- Currency Exchange: For travel and business.

F. Financial Inclusion

Banks promote financial inclusion by providing microfinance and small loans in underserved areas.

3. Key Players in India’s Banking System

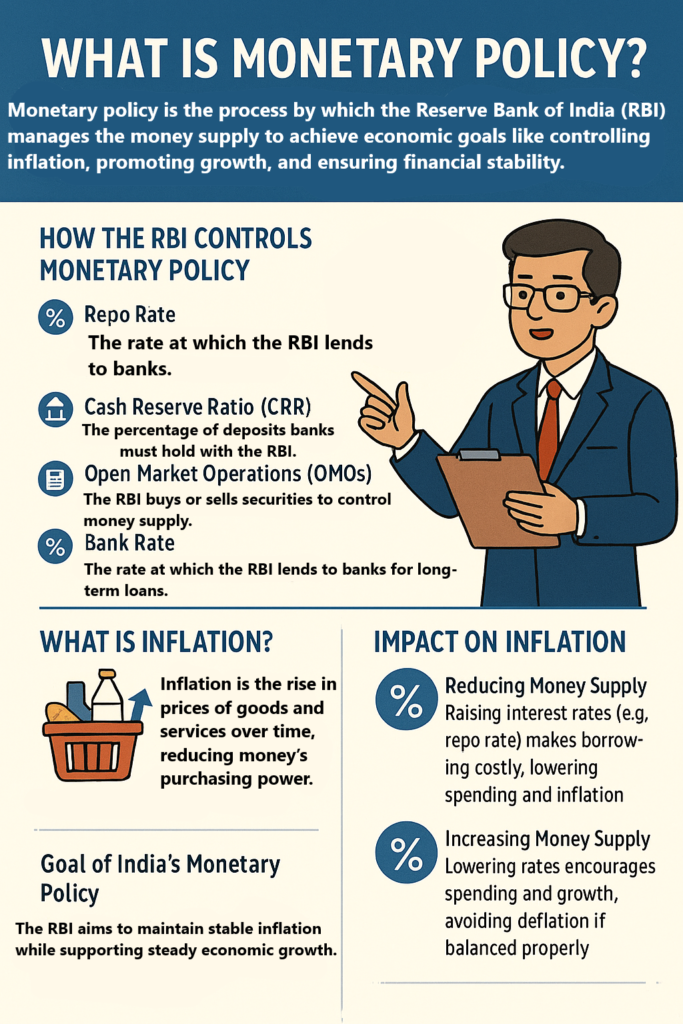

A. Reserve Bank of India (RBI)

The RBI supervises and regulates all banks in India. Its key roles include:

- Regulating Banks

- Controlling Inflation and Interest Rates

- Issuing Currency

- Managing Foreign Exchange

- Acting as Banker’s Bank

B. Commercial Banks

Include public, private, and foreign banks providing direct financial services to individuals and businesses.

C. Non-Banking Financial Companies (NBFCs)

Provide loans, investments, and financial services but cannot accept public deposits.

D. Microfinance Institutions (MFIs)

Offer small, collateral-free loans to low-income individuals, often in rural areas.

E. Cooperative Banks

Serve members in rural and semi-urban areas, supporting farmers, small enterprises, and individuals.

4. Recent Developments in India’s Banking System

- Digital Banking: Growth of mobile apps, internet banking, and wallets like Paytm and Google Pay.

- Financial Inclusion Programs: Initiatives like PMJDY expanding banking access.

- Smartphone-Based Banking: Banks offering services through mobile apps for ease of access.

- Demonetization & Cashless Push: Boosted digital payments across the country.

5. Conclusion

India’s banking system is critical to its economic progress. With a mix of public, private, foreign, and cooperative banks, it offers diverse services tailored to individuals and businesses.

At the center is the RBI, maintaining regulation and stability. Through loans, deposits, investments, and digital innovations, India’s banks promote growth, inclusion, and economic well-being nationwide.