What is a Budget?

A budget is a plan that shows how much money the government expects to earn (revenue) and how much it plans to spend (expenditure) in a particular year. It is like a financial roadmap for the country. For India, the union budget is presented by the Finance Minister every year. This budget shows how the government will manage its finances for the upcoming year.

India’s Budgetary System: Key Components

India’s budgetary system has two major components:

1. Revenue Budget

The Revenue Budget deals with the government’s income and the day-to-day expenses that are required to run the country. It is made up of:

- Revenue Receipts (income): The government’s income mainly comes from taxes (like income tax, GST, and excise duties) and other sources like profits from public sector companies.

- Revenue Expenditure (spending): This is the money the government spends on running its day-to-day functions, such as salaries of government employees, subsidies, interest payments on debt, etc.

The revenue deficit happens when the government’s spending exceeds its income in this part.

2. Capital Budget

The Capital Budget involves the government’s long-term investments, such as:

- Capital Receipts: These are the funds the government gets from borrowing (loans) and other sources like selling assets or privatizing state-owned companies.

- Capital Expenditure: This is the money the government spends on long-term investments, like building infrastructure (roads, bridges, schools, etc.), defense equipment, or research and development projects.

If the government spends more on capital projects than it borrows, it will face a capital deficit.

Key Terms in India’s Budget

- Deficit: A deficit happens when the government spends more money than it earns. There are different types of deficits:

- Fiscal Deficit: This is the overall gap between the government’s total expenditure and its total revenue, including borrowing.

- Revenue Deficit: This is the gap between the government’s revenue expenditure and its revenue receipts.

- Primary Deficit: This is the fiscal deficit minus the interest payments on previous borrowings.

- Surplus: If the government earns more than it spends, it has a surplus. This means there is extra money that can be saved or used for future needs.

How is India’s Budget Made?

The Budget Process in India is carried out in several stages:

- Preparation of the Budget:

- Various ministries and departments of the government submit their budget proposals to the Finance Ministry, outlining how much money they need for the coming year.

- The Finance Ministry then prepares the budget based on the government’s priorities, taking into account the country’s economic conditions.

- Presentation of the Budget:

- The Finance Minister presents the budget in Parliament. The budget is discussed and debated by Members of Parliament (MPs).

- Once the budget is approved by both the Lok Sabha (House of the People) and the Rajya Sabha (Council of States), it becomes law.

- Implementation:

- Once approved, the budget is implemented, and the government begins spending money on its plans, projects, and programs. It also collects taxes and other revenues.

- Review:

- The Comptroller and Auditor General of India (CAG) audits the spending to make sure it is done properly and that the funds are used as planned.

Economic Impact of India’s Budget

India’s budget has a significant impact on the country’s economy. Here’s how:

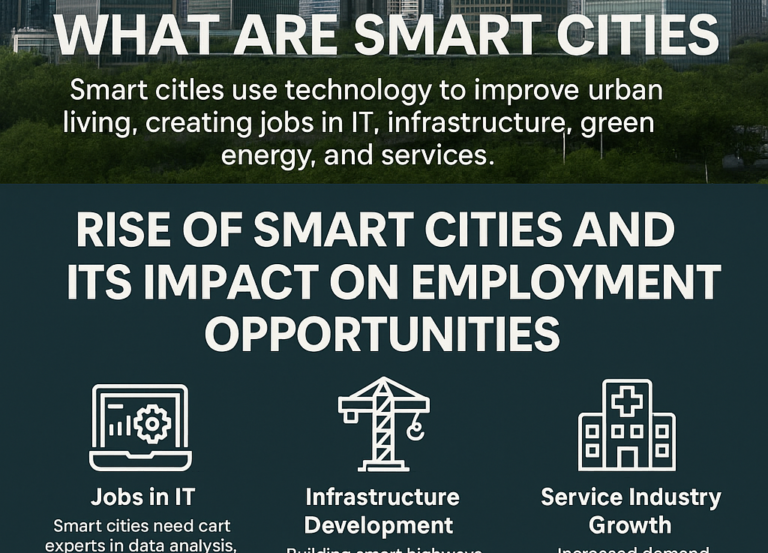

1. Economic Growth

- The government uses the budget to plan and spend on projects that boost economic growth, like building infrastructure (roads, railways, airports), providing subsidies, and supporting industries. When the government invests in projects, it creates jobs, encourages businesses to grow, and helps the economy expand.

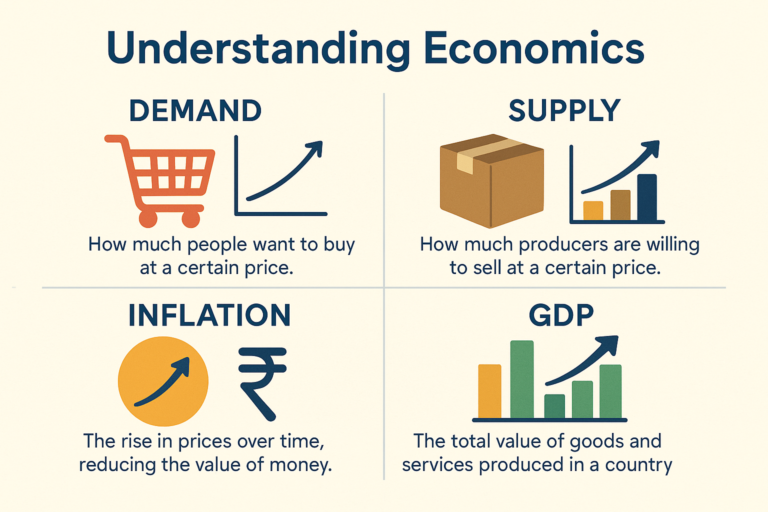

2. Inflation Control

- The budget helps control inflation (rising prices) by managing government spending. For example, if the government increases spending too much, it could cause prices to rise, leading to inflation. On the other hand, reducing unnecessary spending can help bring down inflation.

- The government also controls tax rates, which can impact the spending power of consumers. Lower taxes can encourage people to spend more, while higher taxes might reduce consumer spending.

3. Fiscal Deficit and Borrowing

- The government needs to borrow money if its spending exceeds its revenue. This borrowing increases the fiscal deficit.

- The fiscal deficit has an impact on the economy because borrowing increases the government’s debt. If the deficit is too high, it could lead to higher interest rates and inflation. The budget should balance the need for spending with the goal of keeping the deficit under control.

4. Income Redistribution

- The budget has measures to help reduce inequality in the country by providing welfare schemes for the poor and vulnerable sections of society. This includes schemes like Direct Benefit Transfers (DBT), food subsidies, and healthcare schemes. These programs aim to improve the lives of the poorer sections of society.

5. Investment in Key Sectors

- The budget allocates funds to important sectors like education, healthcare, agriculture, and defense. Investment in education and healthcare improves human capital, which leads to a healthier, more skilled workforce.

- For the agricultural sector, the budget may offer subsidies, loan waivers, or support for farmers to increase productivity.

6. Foreign Investment and Confidence

- A well-balanced and growth-oriented budget can attract foreign investors who look for stable economies to invest in. If the government shows it is managing its finances well and investing in key sectors, it builds investor confidence.

- A budget with clear reforms can also create a favorable business environment, encouraging both domestic and international investment.

7. Tax Reforms

- The budget often introduces tax reforms aimed at improving the tax system, making it simpler and more efficient. The Goods and Services Tax (GST), for example, was introduced through the budget to streamline India’s tax system and make it easier for businesses to operate across states.

Conclusion

India’s budgetary system is a way for the government to plan its finances for the year. It includes both how much money the government will earn and how much it will spend. The economic impact of the budget is huge, as it affects economic growth, inflation, and income distribution. By managing the budget well, the government can ensure that the country’s economy grows, while keeping inflation in check and making sure the welfare of citizens is taken care of.