Understanding Inflation and Deflation : A Simple Guide

Inflation and deflation are terms you often hear when talking about India’s economy. They describe how the prices of goods and services in the country change over time. Both inflation and deflation have big impacts on everyday life, and understanding them can help you make better financial decisions.

1. What is Inflation?

Inflation happens when prices rise over time. When inflation occurs, the value of money goes down, meaning you need more money to buy the same things you could buy before.

How Does Inflation Work?

- Imagine a loaf of bread costs ₹50 today. If inflation is 5%, the same loaf of bread might cost ₹52.50 next year. So, you would need an extra ₹2.50 to buy the same loaf.

- Inflation is usually measured by the Consumer Price Index (CPI), which tracks the average price of a basket of goods and services that people buy in India, like food, gas, and housing.

Causes of Inflation:

There are several reasons inflation can happen:

- Demand-Pull Inflation: This occurs when demand for goods and services increases more than the economy can supply. If people suddenly want more cars, but there aren’t enough cars to meet the demand, the prices of cars go up.

- Cost-Push Inflation: This happens when the cost of production increases (like wages or raw materials), and businesses raise their prices to cover those higher costs. For example, if the cost of petrol increases, transportation costs go up, and the prices of goods also rise.

- Monetary Inflation: When the Reserve Bank of India (RBI) prints more money, there’s more money in the economy, but the number of goods and services doesn’t increase. This can cause prices to rise, as too much money chases too few goods.

Effects of Inflation:

- Purchasing Power Decreases: As prices rise, your money buys less. For example, if inflation is 10% and your salary stays the same, you can buy fewer things with your income.

- Savers Lose Value: If you keep your money in a savings account, inflation can eat away at the value of that money over time. For example, if your savings grow by 2% but inflation is 5%, you’re actually losing money in real terms.

- Borrowers Benefit: If you have a loan with a fixed interest rate, inflation can help you because you repay the loan with money that is worth less than when you borrowed it.

Is Inflation Always Bad?

Not always. A small and steady amount of inflation (usually around 2-4% per year) is considered normal and healthy for the economy. It encourages people to spend and invest, instead of hoarding money, which helps businesses grow.

2. What is Deflation?

Deflation is the opposite of inflation. It happens when prices fall over time. While it might sound good because things get cheaper, deflation can be harmful to the economy.

How Does Deflation Work?

- Imagine the loaf of bread we talked about earlier that cost ₹50. If there’s deflation, next year it might cost ₹47.50 instead of ₹50. The price goes down.

- Deflation is usually measured in the same way as inflation, through the Consumer Price Index (CPI), which tracks price changes.

Causes of Deflation:

Deflation can happen for several reasons:

- Decrease in Demand: If people and businesses stop buying goods and services, there is less demand. As demand decreases, prices fall to encourage people to buy.

- Increased Supply: If there’s more supply than demand, prices also fall. For example, if too many companies produce the same product and there’s not enough demand, the price will go down.

- Monetary Deflation: If the Reserve Bank of India (RBI) reduces the money supply or if people stop borrowing and spending money, it can cause deflation. When there’s less money circulating in the economy, prices fall.

Effects of Deflation:

- People Delay Spending: When prices are falling, people might think, “If I wait longer, things will be cheaper.” This delay in spending can slow down the economy because businesses aren’t selling enough, which leads to further price cuts.

- Wages Fall: As prices drop, businesses might earn less money and start cutting wages or laying off workers. This can lead to more people having less money to spend, which deepens the deflationary cycle.

- Increased Debt Burden: If you have a loan, deflation makes the value of the money you owe more expensive. For example, if you owe ₹1,00,000 and prices are falling, you’ll need more money to pay back that ₹1,00,000 in real terms.

Is Deflation Always Bad?

Yes, in most cases, deflation is considered harmful because it can cause a deflationary spiral. This is when falling prices lead to lower demand, which leads to even lower prices, creating a vicious cycle that harms businesses, wages, and employment.

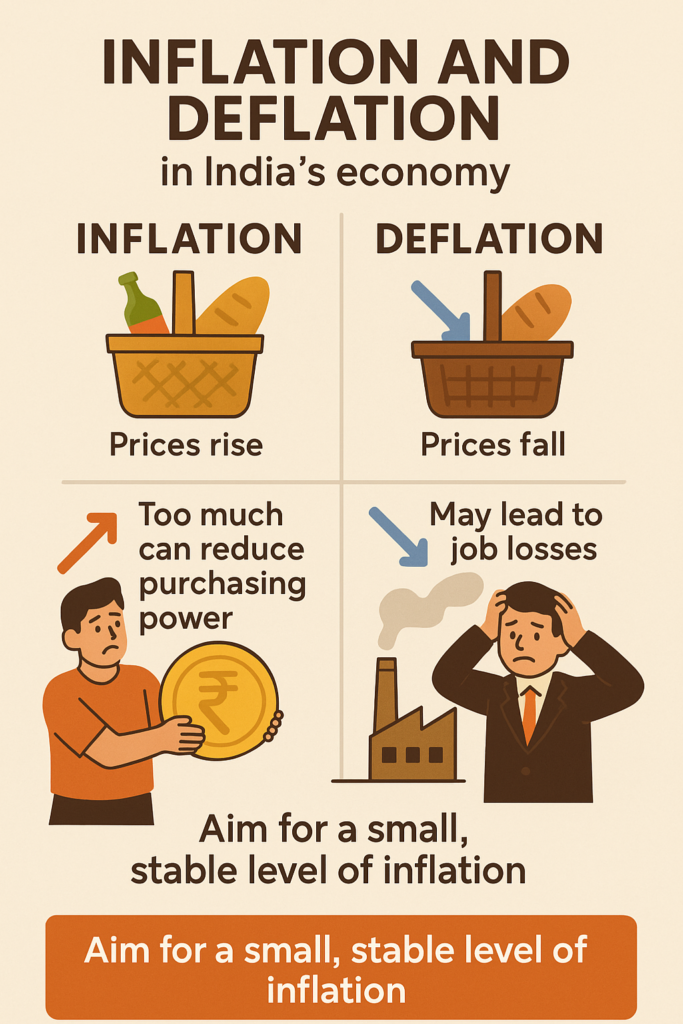

3. The Difference Between Inflation and Deflation

| Feature | Inflation | Deflation |

|---|---|---|

| Prices | Rise | Fall |

| Purchasing Power | Decreases | Increases |

| Consumer Behavior | Spend more quickly to avoid higher prices | Delay spending to wait for even lower prices |

| Wages and Employment | Wages may rise, but jobs can be lost if inflation is too high | Wages and employment often decrease |

| Debt | Beneficial for borrowers, harmful for savers | Harmful for borrowers, may reduce debt burden |

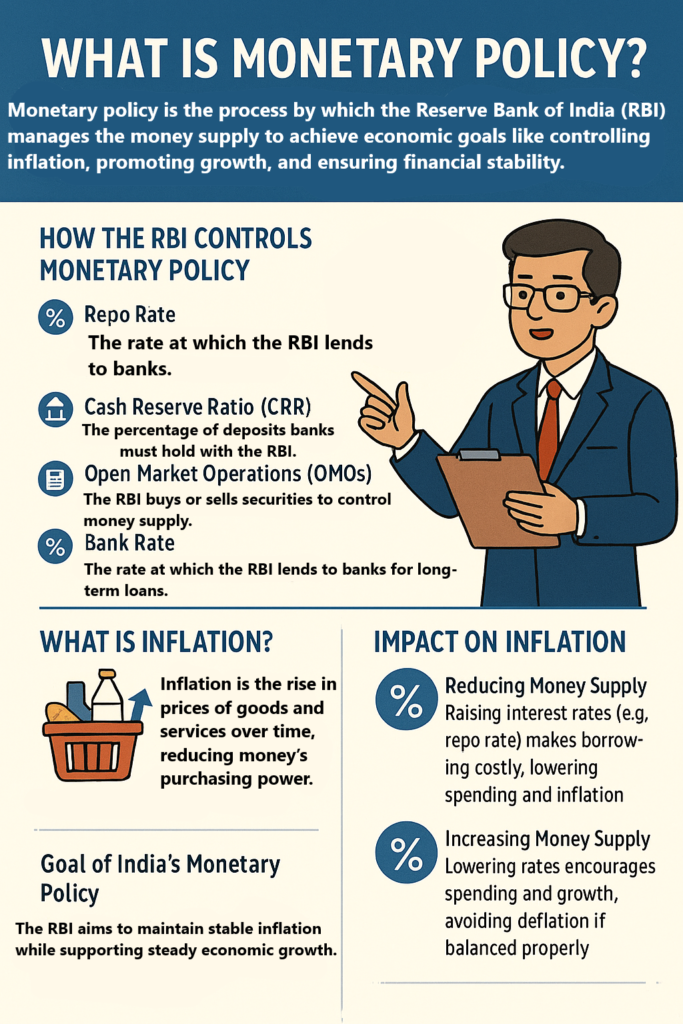

4. How Do Governments Control Inflation and Deflation?

The Reserve Bank of India (RBI) and the Indian government try to control inflation and deflation to keep the economy stable. They can do this by adjusting interest rates, money supply, and fiscal policies.

- Inflation: To control inflation, the RBI may raise interest rates. This makes borrowing more expensive and encourages people to save more. Reducing the money supply can also help slow down inflation.

- Deflation: To fight deflation, the RBI may lower interest rates and encourage borrowing and spending. They can also increase the money supply to stimulate demand and prevent prices from falling further.

Conclusion

- Inflation happens when prices rise, and it’s generally good in small amounts because it helps the economy grow. However, too much inflation can reduce the purchasing power of money and hurt savers.

- Deflation is when prices fall, and while it might seem good at first, it can lead to problems like decreased demand, job losses, and a cycle of falling wages and prices.

Understanding inflation and deflation helps you make better decisions with your money, whether it’s saving, spending, or investing. Both are important to the health of an economy, but the key is to find a balance—a small, stable level of inflation is often the goal for India’s economy.