What is an Economic Recession?

An economic recession is a period of time when the economy of a country (or the world) slows down. It means that people are spending less money, businesses are making fewer profits, and many people lose their jobs. It can be caused by a variety of factors and can affect almost every part of life.

What Happens During a Recession?

During a recession, the economy shrinks for an extended period (usually six months or more). Some of the things that happen during a recession are:

- Less Spending: People feel uncertain about the future, so they spend less on things like shopping, dining out, and entertainment.

- Job Losses: Companies face lower sales and profits, so they may lay off workers or even shut down.

- Business Failures: Small businesses or even big companies may go bankrupt if they can’t make enough money.

- Stock Market Drops: The value of shares in companies may fall, which can hurt people’s investments and savings.

- Reduced Investment: Companies and people become more cautious and invest less money in new projects or businesses.

How Does a Recession Start?

Recessions don’t just happen for no reason. There are several common causes:

- Decline in Consumer Spending: When people stop spending money, businesses make fewer sales, which can cause the economy to slow down.

- Financial Crises: Sometimes, big financial problems, like a bank collapse or stock market crash, can trigger a recession.

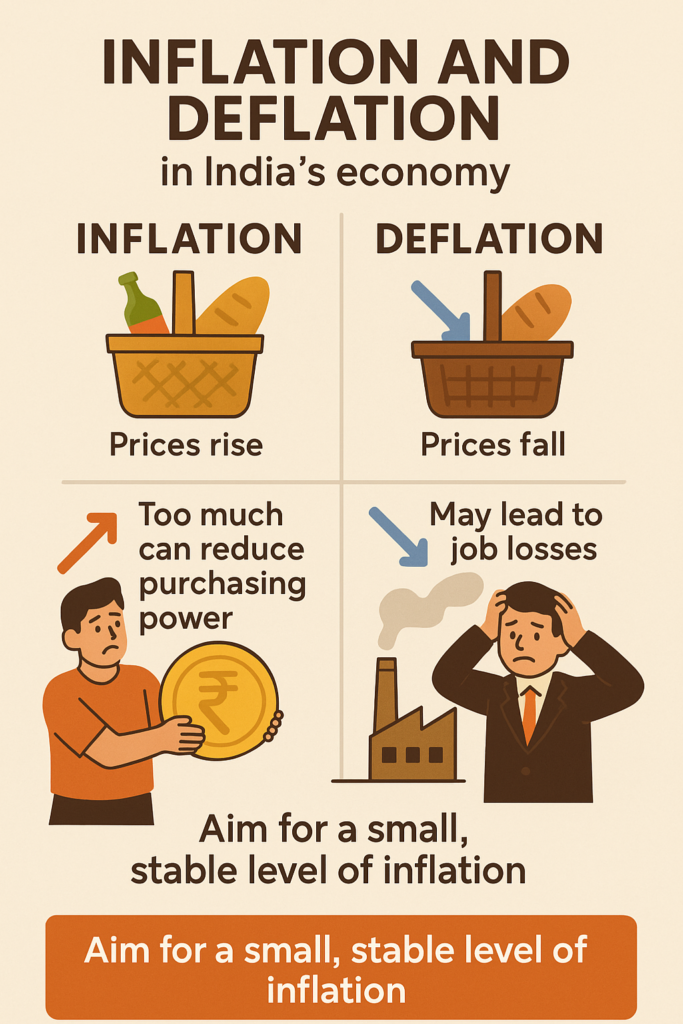

- High Inflation: If prices of goods and services rise too quickly, it can lead to inflation, making things more expensive. This can force people to cut back on spending, leading to a recession.

- Interest Rates: Sometimes, central banks (like the Federal Reserve in the U.S.) increase interest rates to control inflation, but high rates can make borrowing money more expensive and slow down the economy.

- Global Events: Major events like wars, pandemics, or natural disasters can also cause an economic downturn. For example, the COVID-19 pandemic led to a global recession in 2020.

Examples of Major Global Recessions

Let’s look at some of the most well-known global recessions:

1. The Great Depression (1929)

- The Great Depression was the most severe economic downturn in modern history. It began after the Stock Market Crash in 1929 and lasted throughout the 1930s.

- Millions of people lost their jobs, banks failed, and businesses went bankrupt.

- It led to widespread poverty and unemployment around the world, particularly in the U.S. and Europe.

2. The 2008 Global Financial Crisis

- In 2008, the world faced a major recession triggered by the collapse of Lehman Brothers, a large investment bank.

- The crisis was caused by risky investments in the housing market and widespread banking problems.

- It caused a global financial meltdown, leading to job losses, home foreclosures, and bankruptcies in many countries.

- Governments had to step in with bailouts and policies to stabilize the economy.

3. The COVID-19 Recession (2020)

- The COVID-19 pandemic caused a global economic recession in 2020 as many businesses were forced to close, and people stayed home due to lockdowns.

- Many industries like travel, tourism, and hospitality were hit hard.

- Governments around the world introduced stimulus packages to help businesses and individuals survive.

What Are the Effects of a Recession?

- Unemployment: A major effect is that many people lose their jobs, which increases the unemployment rate.

- Falling Prices: In some cases, deflation can occur, where prices of goods and services drop, but people may still avoid spending.

- Poverty: As people lose jobs and income, poverty rates may rise, and it becomes harder for people to afford basic needs.

- Business Closures: Many small businesses may close down, leading to a loss of entrepreneurship and innovation.

- Government Debt: To help the economy, governments often spend large amounts of money on stimulus packages and relief programs, which can increase their national debt.

How Do Governments Respond to Recessions?

Governments and central banks have different tools to help the economy recover during a recession:

- Monetary Policy: Central banks may lower interest rates to make borrowing cheaper, encouraging people to spend and invest more.

- Fiscal Policy: Governments may increase spending on infrastructure, education, or healthcare to create jobs and boost demand.

- Stimulus Packages: During recessions, governments might give stimulus checks or other financial help directly to individuals or businesses.

- Bailouts: In cases of financial crises, the government may step in to help banks or large companies that are at risk of collapsing.

- Job Creation Programs: Governments may create public sector jobs or support industries that can provide employment.

How Can a Recession End?

Recessions don’t last forever. Over time, the economy can recover, and things begin to improve. This might happen through:

- Increased consumer spending: As people regain confidence, they start spending more, helping businesses.

- Economic reforms: Governments may introduce reforms or support industries that can kickstart growth.

- Investment: Once the economy stabilizes, businesses begin to invest in new projects and hiring people again.

- Recovery in global trade: International trade can improve as countries start importing and exporting more goods.

In Summary:

- A recession is a period of economic decline where businesses struggle, people lose jobs, and economic growth slows down.

- Recessions can be caused by things like financial crises, inflation, or global events.

- The Great Depression, the 2008 Financial Crisis, and the COVID-19 recession are some of the most notable global recessions.

- Governments try to fight recessions by lowering interest rates, increasing government spending, and offering financial aid to businesses and citizens.

Recessions are tough for everyone, but they eventually pass, and economies typically recover over time.