What are Financial Institutions?

Financial institutions are organizations that deal with money-related services. They help people save, invest, borrow, and transfer money. Some of these institutions include banks, insurance companies, and investment firms.

In India, banks are the most important financial institutions, and they play a crucial role in the economy by providing services like:

- Accepting deposits (savings accounts, fixed deposits, etc.)

- Offering loans (personal loans, home loans, etc.)

- Providing credit (credit cards, overdraft facilities)

- Facilitating payments (online banking, wire transfers)

Public Sector Banks (PSBs)

Public Sector Banks are banks in which the government of India owns a major part (more than 50%) of the bank’s shares. The government controls these banks and makes decisions about their operations. Here are some key points:

- Ownership:

- The government owns more than 50% of these banks.

- Some examples of Public Sector Banks in India include State Bank of India (SBI), Punjab National Bank (PNB), and Bank of Baroda.

- Objectives:

- The main goal of Public Sector Banks is to provide banking services to all sections of society, especially to the poor and rural areas.

- They focus on financial inclusion, meaning they try to make sure that everyone has access to banking services.

- Government Control:

- Since the government owns these banks, they often have to follow policies set by the government.

- These banks are usually seen as more conservative when it comes to taking risks, as they aim to keep the public’s money safe.

- Services:

- Public Sector Banks provide a range of services like savings accounts, loans, and government schemes (such as PMAY for affordable housing, Jan Dhan Yojana for financial inclusion, etc.).

- Interest Rates:

- Public Sector Banks often offer lower interest rates on loans and savings accounts compared to private banks.

Private Sector Banks

Private Sector Banks are banks that are owned by private individuals, companies, or institutions. The government does not own a majority stake in these banks. Here’s what you need to know:

- Ownership:

- These banks are owned and controlled by private entities. For example, HDFC Bank, ICICI Bank, and Axis Bank are all private sector banks.

- Objectives:

- Private banks focus on profit-making and provide innovative banking services to attract customers.

- They tend to focus on efficiency, customer service, and technology.

- Management:

- Private Sector Banks are run by professional management teams, and decisions are made based on the interests of shareholders (investors) and customers.

- Services:

- Private banks provide similar services to public sector banks, including savings accounts, loans, and digital banking services.

- Private banks are also known for offering better customer service, modern technology, and more personalized banking experiences.

- Interest Rates:

- Private banks may offer higher interest rates on savings accounts and loans, but they can also charge higher fees for some services.

Comparison: Public vs. Private Sector Banks

| Aspect | Public Sector Banks (PSBs) | Private Sector Banks |

|---|---|---|

| Ownership | Majority owned by the government | Owned by private individuals/companies |

| Focus | Financial inclusion, rural areas | Profit-making, customer service |

| Interest Rates | Generally lower interest rates | Often higher interest rates |

| Customer Service | Service may be slower in some cases | Known for better customer service |

| Risk Appetite | More cautious and conservative | More willing to take risks and innovate |

| Examples | State Bank of India (SBI), PNB | HDFC Bank, ICICI Bank, Axis Bank |

| Technology | May be slower to adopt new tech | Often faster in adopting new tech |

| Loan Approval Process | May take longer for approvals | Generally quicker in loan approvals |

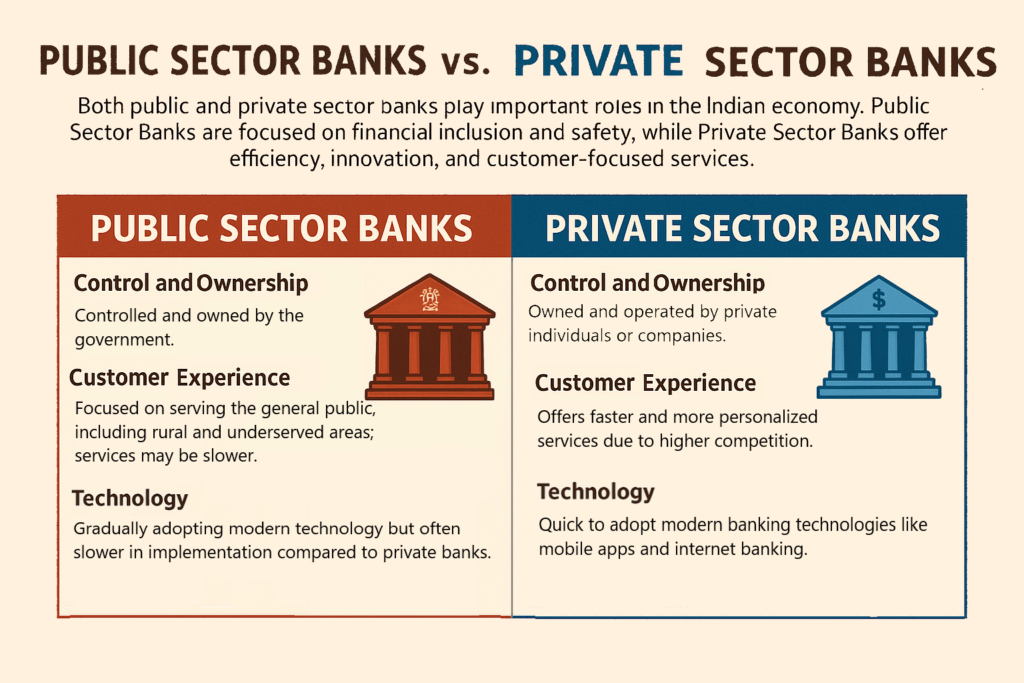

Key Differences

- Control and Ownership:

- Public Sector Banks are controlled by the government, while Private Sector Banks are controlled by private individuals or entities.

- Customer Experience:

- Private Sector Banks tend to provide faster, more personalized services because they are more competitive.

- Public Sector Banks, on the other hand, may be slower at times but are more focused on serving the general public, including the underserved areas.

- Technology:

- Private Sector Banks often lead in using modern technology for online banking, mobile apps, and other innovations.

- Public Sector Banks are catching up but may have a slower pace in adopting new technology.

Which Bank is Better?

It depends on your needs:

- If you want personalized service, advanced banking technology, and quick loan processing, private sector banks may be the better option.

- If you are looking for security, lower interest rates, or banking services in rural areas, public sector banks might be the right choice for you.

Conclusion

Both public and private sector banks play important roles in the Indian economy. Public Sector Banks are focused on financial inclusion and safety, while Private Sector Banks offer efficiency, innovation, and customer-focused services. It’s up to the individual or business to decide which type of bank best meets their needs